Back to blog

Finance Comfort

The question that inevitably comes up at some point during every boardroom meeting is this: “tell me what that costs.” It’s a fair question. Financial decisions directly impact the bottom line. You know what else fuels the bottom line? Employee comfort. If the workplace is too warm or too cold, worker productivity is compromised.

So, while the answer to that aforementioned question, “what’s it going to cost us?” There’s many variables to the answer.

Investing in a new HVAC system comes at a decent price. But, you don’t have to sign over every dollar all at once.

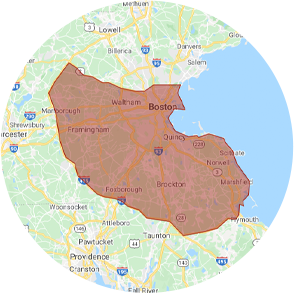

When you engage with Suburban Companies you have the ability to finance 100% of your equipment if you so choose. You can control your ability to pay for your equipment as easily as you can control the environment around you once your HVAC solution is installed and up-and-running.

Flexibility is key when it comes to investing in business operative equipment. You need the ability to scale up or down, and with our financing options at your disposal, those options are as flexible as they come.

A couple of key advantage when working with Suburban and our financial funding partners, Marlin are as follows:

Asset Management – Financing provides the use of equipment for specific periods of time at fixed payments. The financing company assumes and manages the risk of equipment ownership. At the end of the term, if you elect to return the equipment the financing company is responsible for the disposition of the asset.

Tax Advantages – There are tax incentives for purchasing new equipment. By financing your equipment, the amount you save in taxes could be greater than what you pay in the first year of a lease. The implementation of Suburban’s new HVAC equipment could make you money from day one! How’s that for a return?

Keep the following in mind when you start in on your quest to acquire new heating and cooling equipment for your company: There are myriad benefits with regard to “cash flow” that you can take advantage of when you finance your HVAC purchase as opposed to paying with cash or taking out a bank loan. Those benefits are as follows:

- You can acquire new HVAC equipment without a substantial cash outlay.

- You have the flexibility to upgrade or add equipment without any financial difficulty.

- You have the ability to match payments to your unique, current operative cash flow.

- You can avoid affecting your business lines of credit with the bank.

- You’re enabled to customize your payment plan or even defer payments.

Long-term goals for any business vary on a case-by-case basis. When it comes to your company’s bottom line, don’t let “cash on hand” stop you from adding a positive force when it comes to worker comfort (which, as mentioned, has a direct correlation to overall productivity).

Another important financial element to consider is the passage and signing into law of H.R.1, aka, The Tax Cuts and Jobs Act. The deduction limit for Section 179 increases to $1,000,000 for 2018 and beyond when you introduce new HVAC equipment. The limit on equipment purchases likewise has increased to $2.5 million. According to Section179.org, “Using Section 179 with an Equipment Lease or an Equipment Financing Agreement might be the most profitable decision you make this year. Why? Because the taxes you save with the deduction will almost always exceed your cash outlay for the year when you combine (i) a properly structured Equipment Lease or Equipment Finance Agreement with (ii) a full Section 179 deduction. It is a bottom-line enhancing tool that allows you to add new equipment, vehicles, and/or software to your business.”

Further, the bonus depreciation is 100% and is made retroactive to 9/27/2017 and good through 2022. The bonus depreciation also now includes used equipment.

If you’re thinking about the acquisition of new HVAC equipment give Suburban Companies a call to discuss the options at hand. We’ll outfit you with exactly what you need without a huge upfront investment. Take comfort. We’re here to help.